News

Latest news

More...

Hapag-Lloyd Implements New Rate Increase From East Asia To North America

Hapag-Lloyd announced a general rate increase (GRI) from East Asia to North America for cargo transported in dry, reefer and special containers, including high cube equipment.

Hapag-Lloyd announced a general rate increase (GRI) from East Asia to North America for cargo transported in dry, reefer and special containers, including high cube equipment.

More specifically, there will be a rate increase of US$800 per all 20′ container types and a US$1,000 increase per all 40′ container types.

The German ocean carrier said the general rate increase will be applicable to all containers gated in full from 1 May 2023 and will be valid until further notice. The GRI will be applied from Japan, Republic of Korea, Taiwan (PRC), Hong Kong (PRC), China (PRC), Macau (PRC), Vietnam, Laos, Cambodia, Thailand, Myanmar, Malaysia, Singapore, Brunei, Indonesia and the Philippines to the United States and Canada.

The Chennai Port Trust and its subsidiary Kamarajar Port Ltd have set a target of crossing 100 million metric tonne of cargo in the current financial year.

The Chennai Port Trust and its subsidiary Kamarajar Port Ltd have set a target of crossing 100 million metric tonne of cargo in the current financial year, a top official said here on Monday. Both the ports handled 92.46 million metric tonne of cargo in the last financial year, Chairman and Managing Director Sunil Paliwal said.

On the performance of the Ports, he said Chennai Port Trust handled 48.95 million metric tonne of cargo, which was up by 0.8 per cent from 48.56 million metric tonne handled last year.

Kamarajar Port handled 43.51 million metric tonne of cargo in 2022-23 up by 12.31 per cent from 38.74 million metric tonne recorded the previous year.

“Container is the major cargo handled by Chennai Port Trust. It is about 58 per cent. While liquid bulk and dry bulk cargo also witnessed a good growth this year,” he told reporters.

To a query, the Chairman said exports of automobiles grew last year at Chennai Port Trust following the signing of agreements with several automajors including Toyota.

The exports by these companies from Chennai Port had offset the loss incurred due to the exit of US car maker Ford from Chennai last year, he said.

“Export of cars at Chennai Port Trust rose by 36 per cent to 2,31,412 units in FY2022-23 while it was 1,70,482 units in FY 2021-22.”

Kamarajar Port exported 1,48,307 units in 2022-23 as compared to 1,35,702 in 2021-22.

“Together both the Ports handled about 3,79,719 units of cars last year,” he added.

In a boost to cruise tourism, Paliwal said Switzerland based MSC Cruises, part of the MSC Group, was in discussion with the Chennai Port Trust for offering cruise tourism from the coastal town.

“They are planning to have Mumbai as a hub for cruise tourism in the western coast and Chennai as a hub in the eastern coast. From 2024 onwards, they (MSC Cruises) may commence operations from Chennai Port,” he said.

Chennai Port Trust in 2022-23 handled 37 Cruise ship calls carrying 85,000 passengers.

Regarding the financial performance, the official said Chennai Port reported its highest net surplus (profit before tax) in the last 13 years at Rs 150.26 crore in FY2022-23.

“This is a 33 per cent year-on-year increase in net surplus over last financial year 2021-22,” he said.

The highest net surplus achieved at Chennai Port would enable them to invest in developing the existing infrastructure projects.

As regards the financial performance of Kamarajar Port, Paliwal said the port surpassed Rs 1,000 crore mark as income to reach Rs 1,002.45 crore.

“This is an increase of 17.82 per cent from Rs 850.84 crore registered in 2021-22.”

Kamarajar Port registered a net surplus of Rs 669.93 crore in FY2022-23 which was an increase of 24.39 per cent from the earlier Rs 538.59 crore registered last year, he said.

Responding to a question on ongoing projects by Kamarajar Port, he said the cargo handling capacity at the port is being expanded with construction of RoRo cum GCB-II (3 metric tonne per annum) at an investment of Rs 161.09 crore.

Kamarajar Port is undertaking a capital dredging Phase-VI project to provide 18 metre draft to handle bigger container vessels at an estimated cost of Rs 549 crore, he added.

Shanghai-based Hudong-Zhonghua Shipbuilding (Group) built and delivered the largest container vessel in the world to Mediterranean Shipping Company (MSC).

MSC Tessa has a container capacity of 24,116 TEUs and is the first of four same-size container ships purchased by the largest container line in the world.

According to Hudong-Zhonghua, a unit of China State Shipbuilding Corp (CSSC), the vessel is currently the world’s largest boxship in terms of TEU capacity.

The mega container vessel measures 399.99 metres in length and 61.5 metres in width.

Hudong-Zhonghua Shipbuilding Group reported that the second vessel on order from the series has completed sea trials and that the other two sister vessels are also under construction. All the remaining boxships are expected to be delivered before August 2023.

other goods loaded upon the same vessels have also been tested, properly certified and handled correctly, to minimise potential risks to our own cargo. We believe this is a milestone for the industry and will quickly gain wider adoption,” said Yoyo Ju, Lead of Order Fulfillment Center - Doc Management at Midea.

The company has estimated average transit times from Novorossiysk at two days for Istanbul, 14 days for Jeddah, 22 days for Mundra and 24 days for Nhava Sheva.

Ruscon, a leading multimodal transport logistics provider in Russia, has significantly expanded its containerised service network from the Black Sea port of Novorossiysk to Nhava Sheva (JNPT) and Mundra in West India as volumes rapidly rise.

The company, a Delo Group subsidiary, has now increased its tonnage deployments from one vessel to four vessels to provide a weekly sailing frequency on the route.

Additionally, an extra stop has been introduced at Saudi Arabia’s Jeddah Port. The service rotation already included a call at Istanbul Port in Turkey.

The company has estimated average transit times from Novorossiysk at two days for Istanbul, 14 days for Jeddah, 22 days for Mundra and 24 days for Nhava Sheva.

“A regular multimodal service between India and Russia has been operational since July 2022, providing containerized cargo shipments from anywhere in Russia through Delo Group’s terminals in Novorossiysk to the Indian ports of Mundra and Nava Sheva,” Moscow-based Delo Group noted.

According to Ruscon’s head Sergey Berezkin, “With the increase in the number of vessels, we are offering customers the best delivery cycle in the market for optimal planning of the shipment schedule.”

Berezkin went on to explain, “The additional call at Jeddah Port will open up new opportunities for shippers interested in shipping to/from Saudi Arabia, which is one of the key states in the region.”

That move comes on the heels of FESCO (Far Eastern Shipping Co.), Russia’s largest ocean container carrier, adding a direct shipping connection on the same route. The inaugural call at Nhava Sheva was made last week, according to local sources.

With cargo volumes between India and Russia building up, niche Indian NVOs, non-vessel owners, have also begun deploying vessels on inducement.

Mumbai-based Econship is one such new entrant into this lucrative market.

The traditional NVO connects Nhava Sheva and Mundra to Novorossiysk, with extended inland reach for St. Petersburg and Moscow. It has phased in a 900-TEUs vessel, with plans to offer a regular monthly sailing frequency once settled into the market.

Econship currently offers a transit time of 16 to 18 days from Nhava Sheva to Novorossiyk.

Company sources said it has made three calls out of West India for Russian ports over the past two months.

Iran Shipping Line (IRISL) has also been more actively moving cargo between Russia and India via the International North South Transport Corridor (INSTC), under a multi-modal logistics model, after western sanctions on Moscow had forced regular mainline operators to suspend operations/bookings out of Russia.

Dry exhaust gas cleaning system installed on bulker Bontrup Amsterdam (SodaFlexx)

With traditional scrubber systems coming under increasing pressure for the wash residue which environmentalists highlight as a pollutant, a dry exhaust system sodium compound provides an alternative that can permit older, in-service ships to meet increasing emissions regulations. A dry system was recently installed on a Dutch-owned bulker with its manufacturer also highlighting the potential for a containerized system that further eases operations.

The Integrated Dry Exhaust Gas Cleaning System developed by UK-based SodaFlexx was recently installed on the Bontrup Amsterdam, a 39-year old dry bulker owned by the Dutch company Bontrup. Built in 1984, the vessel is 65,400 dwt and 736 feet long powered by a traditional heavy fuel propulsion plant. The installation of the dry exhaust system took place during the last week of February in Amsterdam. According to the companies the installation required less than three days with the vessel resuming service last week sailing from The Netherlands to the UK.

“The technical installation of the SodaFlexx System has been successfully completed and the commissioning is going to take place in March 2023. The project is running smoothly, although we had to make some adjustments right before the installation,” said Elwin Koning, Managing Director, Engineering at SodaFlexx. “The system offers a lot of flexibility and we have a wide range of options we can incorporate to achieve an optimized installation. This new SodaFlexx system uses our advanced Hyperion technology which uses AI to ensure optimal absorbent dosage for the required emissions zone.”

The SodaFlexx dry powder unit injects sodium bicarbonate powder directly into the exhaust gas stream to neutralize sulfur compounds (SOx). In the heat and turbulence of the exhaust gas stream, a chemical reaction occurs converting SOx to a highly stable and non-toxic salt. This salt is released safely into the atmosphere or can be captured by a cyclone particulate capture system and recycled ashore.

SodaFlexx highlights that the system allows vessels to burn HSFO (High Sulfur Fuel Oil). It can be connected to the main engine and also to auxiliary generators, boilers, and incinerators. The company offers an option for a prefabricated containerized and stackable units on a TEU footprint.

In addition to permitting the use of the lower-cost HFSO option versus Marine Gas Oil (MGO), the company also highlights that most older marine engines were designed to burn HFO. The dry exhaust system offers an option that is environmentally sensitive while permitting the ship’s owners to follow existing maintenance and lubrication protocols for their in-service ships.

“Finding the balance between economical and environmentally friendly solutions for the maritime industry is the ultimate goal of our business,” says Barry Bednar, CEO of SodaFlexx. “The transition to alternative fuels won’t happen overnight and we still have a global fleet to operate in the most sustainable way possible, and burning HSFO with our exhaust gas cleaning system has proven to be less CO2 intensive than using MGO or VLSFO on a “well to wake” basis.

The basis for the system, sodium bicarbonate, is produced by many manufacturers and on all continents. The company offers a containerized solution for the material aboard the ships or it can be delivered by truck or barge. The residue is also easy to recycle versus wash water from wet scrubbers which is increasingly being regulated.

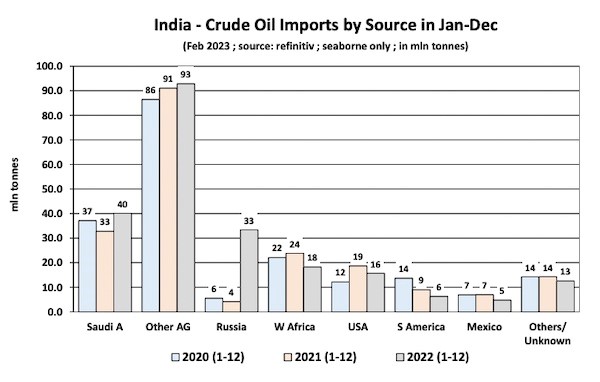

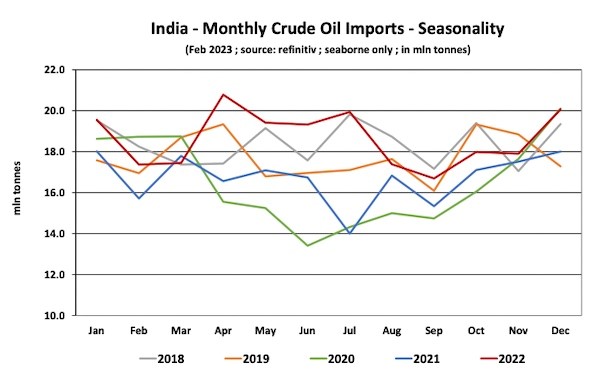

India is now the third biggest importer of crude oil, with a market share of 11% of global crude oil imports. In its latest weekly report, shipbroker Banchero Costa said that “2022 has turned out to be a very positive year for crude oil trade, despite the surging oil prices and risks of economic recession. In the full 12 months of 2022, global crude oil loadings went up +8.7% yo-y to 2,049.8 mln tonnes, excluding all cabotage trade, according to vessels tracking data from Refinitiv. This was well above the 1,886.3 mln tonnes in Jan-Dec 2021, but slightly below the 2,110.5 mln tonnes in the same period of 2019.

According to the shipbroker, “exports from the Arabian Gulf were up +12.8% y-o-y to 879.5 mln t in 2022, and accounted for 42.9% of global seaborne crude oil trade. Exports from Russia have also increased by +10.3% y-o-y to 218.4 mln tonnes, or 10.7% of global trade. From the USA, exports surged by +22.8% y-o-y to 165.0 mln t. From West Africa, however, exports declined -2.3% y-o-y to 170.7 mln t. From the North Sea, exports were also down by -1.9% y-o-y to 107.4 mln tonnes in Jan-Dec 2022. In terms of demand, seaborne imports into the European Union (27) increased by +12.2% y-o-y to 451.7 mln t in Jan-Dec 2022, with the EU accounting for 22.3% of global seaborne crude oil imports. Imports to India also surged +11.5% y-o-y to 223.8 mln t in 2022. Imports to China, however, declined by -2.6% y-o-y to 438.7 mln t, the lowest level since 2018”.

According to the shipbroker, “exports from the Arabian Gulf were up +12.8% y-o-y to 879.5 mln t in 2022, and accounted for 42.9% of global seaborne crude oil trade. Exports from Russia have also increased by +10.3% y-o-y to 218.4 mln tonnes, or 10.7% of global trade. From the USA, exports surged by +22.8% y-o-y to 165.0 mln t. From West Africa, however, exports declined -2.3% y-o-y to 170.7 mln t. From the North Sea, exports were also down by -1.9% y-o-y to 107.4 mln tonnes in Jan-Dec 2022. In terms of demand, seaborne imports into the European Union (27) increased by +12.2% y-o-y to 451.7 mln t in Jan-Dec 2022, with the EU accounting for 22.3% of global seaborne crude oil imports. Imports to India also surged +11.5% y-o-y to 223.8 mln t in 2022. Imports to China, however, declined by -2.6% y-o-y to 438.7 mln t, the lowest level since 2018”.

Banchero Costa said that “in 2022, India was the third largest seaborne importer of crude oil in the world, after the European Union and Mainland China. Last year, India accounted for 11.0% of global crude oil imports, in what remains a very fragmented market. The world’s top importer, the EU, accounts for 22.3% of global volumes, and China for 21.6% Imports into India have grown rapidly over the years, driven both by domestic demand but also due to the establishment of a large exportoriented refining industry. India’s seaborne crude oil imports in the 12 months of 2022 increased by +11.5% y-o-y to 223.8 mln tonnes, from 200.7 mln tonnes in 2021. Volumes were particularly high in 2Q 2022 with 59.5 mln tonnes, up +18.1% y-o-y and the strongest quarter on record. The major crude oil import terminals in India are: Jamnagar (64 mln tonnes discharged in 2022), Vadinar (43 mln tonnes in 2022), Paradip (29 mln tonnes), Mundra (18 mln tonnes), Mumbai (16 mln tonnes), Cochin (15 mln tonnes), Chennai (9 mln tonnes), Visakhapatnam (8 mln tonnes). About 51 percent of crude oil volumes discharged in India in 2022 were carried in VLCCs, about 35 percent of Suezmaxes, and 13 percent on Aframaxes. The vast majority of imports are sourced from the Arabian Gulf, accounting for 59% of India’s total imports in 2022. Volumes from the Arabian Gulf to India increased by +7.4% y-o-y in 2022 to 133.0 mln tonnes”.

Source: Banchero Costa

The shipbroker added that “the single largest supplier to India is Iraq, with 51.6 mln tonnes in the 12 months of 2022, or 23 percent of India’s total imports. In second place was Saudi Arabia, with 40.1 mln tonnes in 2022, or 18 percent of the total. The UAE accounted for 21.8 mln tonnes, or 10 percent, with Kuwait in fourth spot with 11.9 mln tonnes and 5 percent in 2022. Aside from the Gulf, the largest exporter to India is now Russia. In 2022, India imported 33.4 mln t of crude oil from Russia, up +705.1% yo-y from just 4.1 mln t in 2021. Russia now accounts for 15% of India’s crude oil imports. On the other hand, volumes from West Africa to India declined by -23.4% y-o-y in 2022 to 18.2 mln t. Shipments from the United States to India also declined by -16.1% y-o-y in 2022 to 15.7 mln t. From South America there has also been a -29.7% y-o-y decline to 6.3 mln t in 2022. From Mexico, volumes were down by -31.9% y-o-y to 4.7 mln t in 2022”, Banchero Costa concluded.